what is an offset account?

An offset account is typically an everyday transaction account and the amount in this account is used to “offset” the interest on your mortgage, helping you pay it off sooner! This offset account and your mortgage account are essentially linked, helping you pay less interest over the life of the loan. Basically the more money you have in your offset account, the less interest you pay on your mortgage. You can use this account like any other typical everyday banking account by having your pay deposited into the account and making regular direct debt transactions, use ATM’s or make EFTPOS purchases.

A few things to know though - you don’t earn interest on offset accounts like you do in a typical savings account as obviously the design of the account is to reduce interest paid elsewhere. You can’t have your cake and eat it too!

As with all personal finance choices make sure having an offset account suits your situation and talk with your bank, lender, mortgage broker, accountant or financial adviser before you sign up. Ensure you understand everything involved and how it affects your situation! Otherwise, let’s use an example to unpack this idea a bit more.

here’s an example:

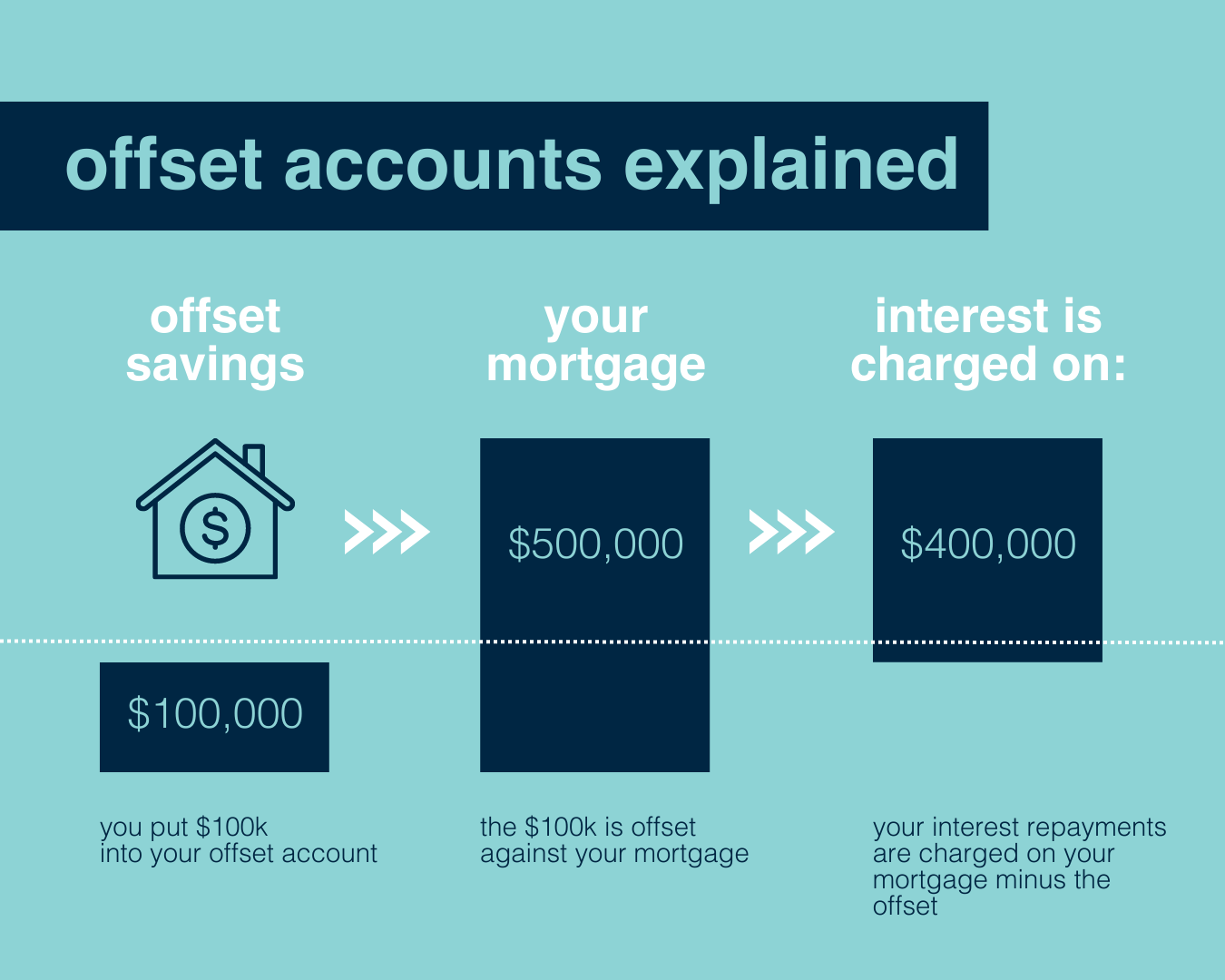

Let’s pretend you had a mortgage of $500,000 and the interest rate was 4.60% – without an offset account the annual interest you would pay would be $23,000.

If the same mortgage had an offset account and there was $100,000 sitting in this offset account, you would only be charged interest on $400,000 or $18,400 in interest each year.

Using this scenario – that's a saving of $4,600 per year on interest.

This $100,000 in the offset account would not earn interest at all – you just wouldn't pay interest on that part of the mortgage.

If the $100,000 was in a stand alone savings account earning 1.5% interest – you would have earned $1,500 interest.

So the actual benefit of the offset account is $3,100 ($4,600 less $1,500).

The true advantage is that you have effectively earned $4,600 of interest tax free by using this offset account, as you would have to pay tax on your $1,500 earned.

Here’s a diagram that can help understand the concept:

where to next?

Subscribe to the my millennial property podcast

Reach out to connect with a mortgage broker

Read our blog - 8 first home buyer fundamentals

Read our blog - 8 property investor fundamentals